Tonight, we have reports of tax refunds landing in bank accounts without notice. Yeah, these deposits are part of an identity theft scheme that uses the victim from start to finish. A new six investigator, Michael Felt, has this week's edition of schemes and ripoffs. There is an outstanding amount that has been fanning under yelling. New six has been tracking IRS imposter calls for the last four tax seasons. So, you just need to be with the government this time. The tax scheme involves government refunds that were never supposed to be received. What they are doing is filing a fraudulent tax return and using your bank account information to have that refund deposited into your account. That deposit is followed by an IRS phone call saying you need to withdraw the funds and send it to a bogus government account. There can be multiple victims in that scenario because it can be that the return was filed using your information, your social security number. IVA Velasquez, President, and CEO of the Identity Theft Resource Center tells News six her team has been tracking reports of these surprise IRS bank deposits for the last couple of months. It's a new play on identity theft. What the scammers need to have is your account information as well as your contact information because the scam doesn't work unless they can reach out to you and pretend to be the IRS. The IRS issued an update on February 13th, reporting victims jumped from a few hundred to several thousand in just days. At this point, IRS investigators still aren't sure who is behind it, but we do know this: if you get one of these calls and they say that the money doesn't belong there, hang up and report it to the...

Award-winning PDF software

8879 california 2025 Form: What You Should Know

Date you were authorized to e-file tax return. Your signature. Signature of the person in whom you have the most financial interest (i.e. the person to whom you signed the return). Signed this form, but I did not file it with the FT. Taxpayers may use Form 8879-FID when e-filing taxes as a tax preparer. The FT. Taxpayer should: TAXBLEYEAR DO NOT MAIL THIS FORM TO THE FT. California e-file Signature Authorization for Fiduciaries. 2018 Form 8879-SF— California e-file Signature Authorization for Corporations. Form 8879-SF — California e-file Signature Authorization for Corporations. By signing this form, the taxpayer authorizes the e-filer to enter information about the corporate status of the corporation on his or her 2025 tax return. Form 8879-SF (Rev January 21, 2019) — Franchise Tax Board TAXABLE YEAR. 2017. FORM. 8879-SF. DO NOT MAIL THIS FORM TO THE FT. California e-file Signature Authorization for Fiduciaries. By signing this form, the taxpayer authorizes the e-filer to enter information about the corporate status of the corporation on his or Form 8879-SF— California e-file Signature Authorization for Corporations. By signing this form, the taxpayer authorizes the e-filer to enter information about the corporate status of the corporation on his or TAXABLE YEAR. 2015. FORM. 8879-SF. TAXABLE YEAR. 2018. FORM 8879-SF. DO NOT MAIL THIS FORM TO THE FT. California e-file Signature Authorization for Fiduciaries. By signing this form, the taxpayer authorizes the e-filer to enter information about the corporation's tax filing status on his or Form 8879-SF — California e-file Signature Authorization for Corporations. Form 8879-SF — California e-file Signature Authorization for Corporations. By signing this form, the taxpayer authorizes the e-filer to enter information about the corporation's tax filing status on his or TAXABLE YEAR. 2014. FORM. 8879-SF. TAXABLE YEAR. 2015. FORM. 8879-SF. DO NOT MAIL THIS FORM TO THE FT. California e-file Signature Authorization for Fiduciaries.

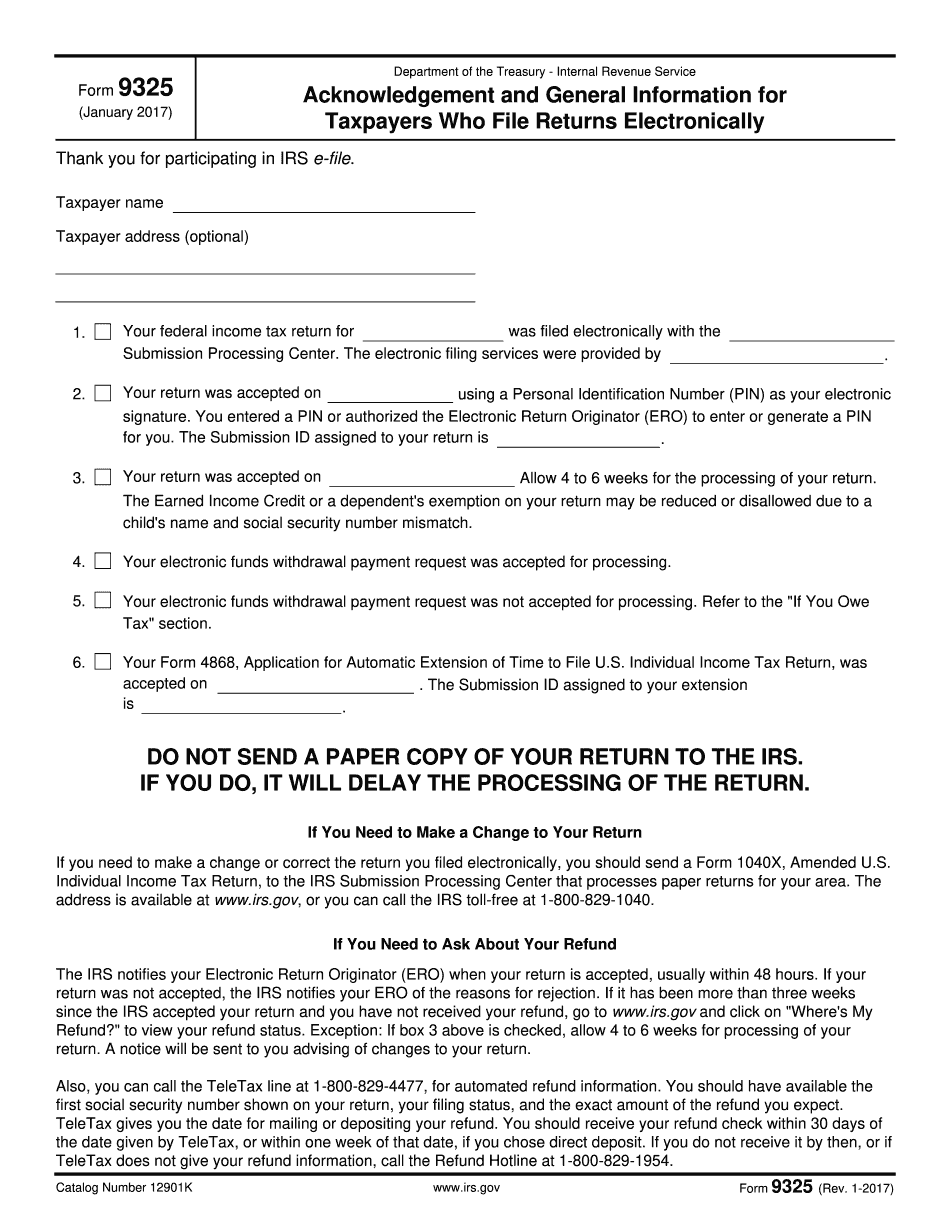

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9325, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9325 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9325 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9325 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8879 california 2025