My name is Elizabeth Cole, and I am the director of communications here at Trilogy Software. I do webinars along with my other talented colleagues. E-file season is starting a little later this year, so this is the usual time of year that we do this presentation. However, there are still some things changing in the tax cycle before e-file opens in a little while. Today's topics are related to e-file. We are going to talk about what's new this year and changes to the T183 authorization form. If you have done e-file before, you will notice some differences. We will also show you how to file a single return using e-file in the basic tax cycle. We will discuss a couple of other types of things you can file in an individual's tax return, such as the T1135 and pre-authorized debit requests. Additionally, I will show you some tax cycle tricks and tips to make filing multiple types of things at the same time easier. This includes transmitting family returns and how to batch transmit in the client manager. This information might be relevant this year, especially if you have a lot of easy returns that you're preparing. The e-file system doesn't open until later this month, so you might find that you can get ahead of those returns before opening and then batch transmit them. Lastly, I will show you how to file a T1 adjustment in tax cycle. The CRA allowed software like tax cycle to file adjustments like the T1 ATJ for your clients last year. If you need to make an amendment to a T1 return, you can do that electronically now, and tax cycle makes it slightly easier. I wanted to show you that today at the end. Moving on to the topics of...

Award-winning PDF software

2018 efile Form: What You Should Know

Back Taxes Form 1116. Note, this form may not be completed online. Form 1116 (filed). If you are an individual taxpayer, the original form is to be filed with a tax return from January 1 through December 31. This form should attach to your e-mail, with a cover letter that states your tax identification number to establish that you mailed it. If you are an LLC or corporation, the original form is to be filed with a tax return from January 1 through April 30. All returns from this two-year period, if filed on time, will be filed electronically. This form should attach to your e-mail, with a cover letter that states your tax identification number to establish that you mailed it. You should file Form 1116 for each entity. Please do not attach this form to a paper return. Back Taxes Form 1 for Tax Returns From 2018-21, and for Business Entities. Tax forms and instructions for Forms 1 (Individual) and 801 (Lifestyle Property of an Individual). Form 1 (Individual) for individuals who earned at least 200,000 from an income from a job. Form 817 (Partnerships with shareholders). Form 817 (Partnerships with shareholders). Note, this form may not be completed online. Form 868 (Partnership Interest). Form 8712 (Nonresident Return). Note, this form may not be completed online. Form 952 (Estate and Gift Taxes). Note, this form may not be completed online. Form 953 (Foreign Personal Property Assets). Form 956 (For Sale of Real Estate Interests). Note, this form may not be completed online. For corporations, Form 990-EZ (Internal receipts). Note, this forms can be completed online. Form 990 (Information Return) Back Taxes Form 1541 (Deductions for Property) back taxes. Form 1541 (Deductions for Property); Form 8841 For tax years 2025 and later. Form 1541; Form 8841; Form 8731 (Business Income Tax) (Note, this form may not be completed online) for taxpayers from 2025 to 2025 who earned at least 200,000 from a job. For tax years 2025 and later.

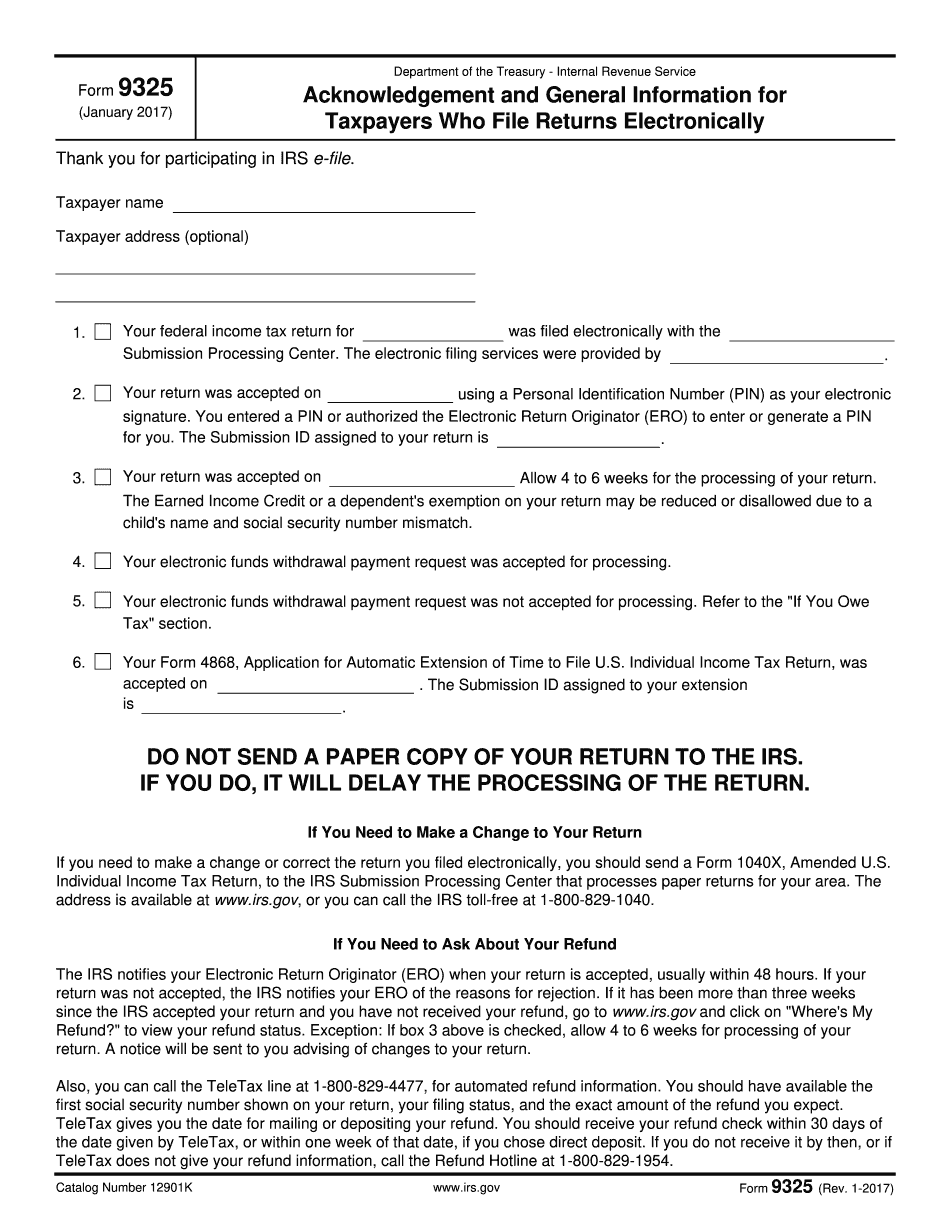

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9325, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9325 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9325 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9325 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 efile form