Award-winning PDF software

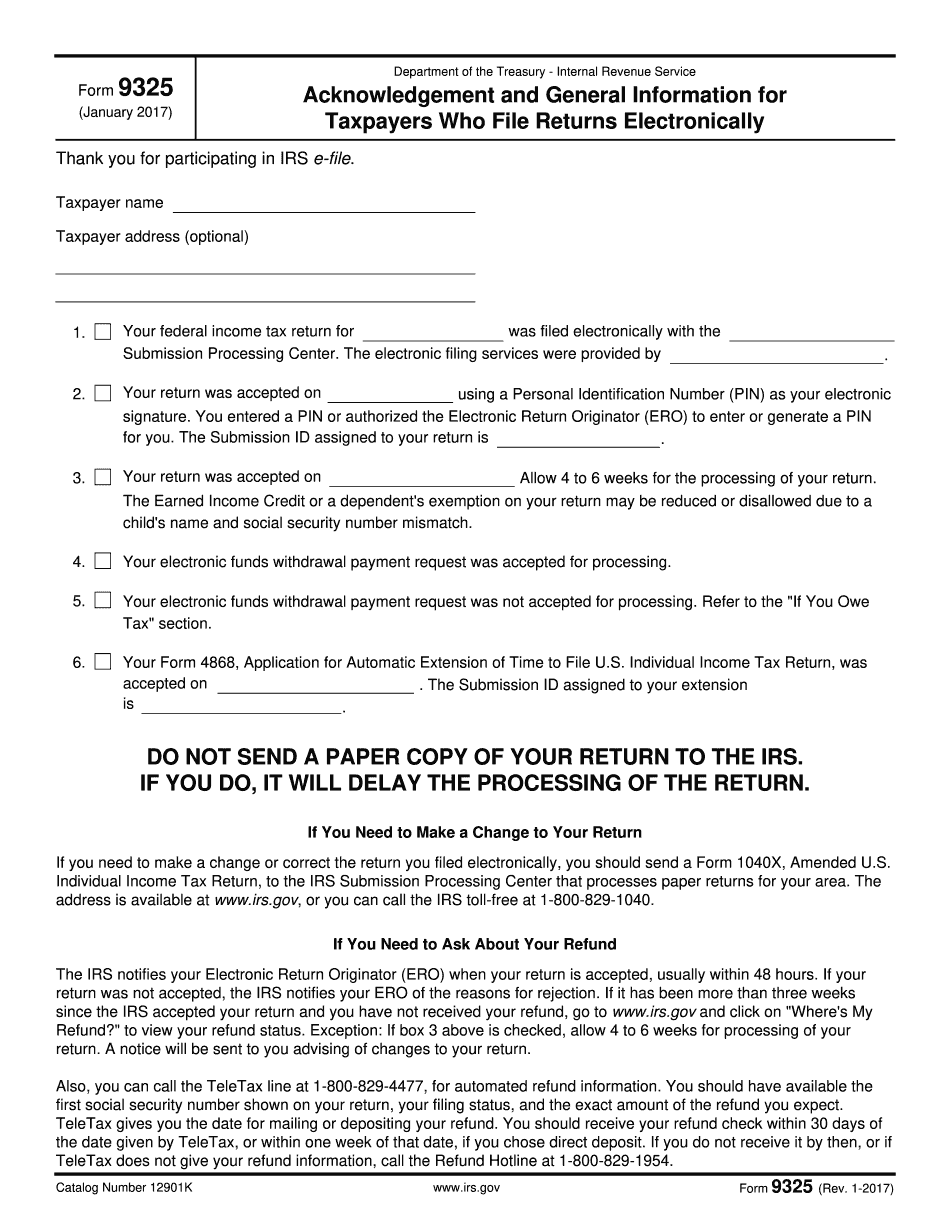

Form 9325, acknowledgement and general information for

CFR Parts 2001 et seq. 10 CFR Part 1004. 30 CFR Part 1004. 30 CFR Part 1010. 35 CFR Part 1031. 35 CFR Part 1035. Publication No. 23 CFR Part 1024, acknowledgement, acknowledgement, and general information for taxpayers who file by facsimile (fax, e-mail, or postal mail) and who claim the electronic filing credit. Publication No. 27 CFR Part 2001, acknowledgement, acknowledgement, general information for taxpayers who file by facsimile (fax, e-mail, or postal mail) and who claim the electronic filing credit. Publication No. 30 CFR Part 1026, acknowledgement, acknowledgement, and general information for taxpayers who file by facsimile (fax, e-mail, or postal mail) and who claim the electronic filing credit. Publication No. 35 CFR Part 1040, acknowledgement, acknowledgement, general information for taxpayers who file by facsimile (fax, e-mail, or postal mail) and who claim the electronic filing credit. Publication No. 35 CFR Part 1041, acknowledgement, acknowledgement, general.

Form 9325 - acknowledgement and general information

If you do not receive a copy of your tax return or extension by 10/29/2018, you should start contacting the IRS. There are penalties for non-filing, such as interest and penalties and withheld payments. It is extremely important that you check your mail frequently. Do not wait until the last minute to check your mail. You will need to start the return or extension process soon. Remember, you can only file as a joint return, unless a filing status of separated and filing joint returns exists in your federal tax return. Joint return refers to the filing status and filing status of two individuals who file one tax return, such as a joint federal tax return or an individual non-resident alien tax return.” Here's a quick video guide for filing Form 9325: How long does Form 9325 last? How long does it take to file Form 9325? It depends upon a number.

- form 9325 fill online, printable, fillable

You may also mail a copy of this form to : The IRS Attn: Accounts Box 80528 Chicago, IL 60 This form MUST go to the Chicago offices where you filed your return as well as all other federal income tax returns filed within the state of Illinois. Income Tax Filing Requirements Income tax forms are available for download from the Treasury website at: The forms are in PDF format, and you may download them for free. You must be a citizen or resident to be eligible for a Federal income tax return on your Illinois tax return. You can also mail a copy of your Illinois federal tax return to: The Illinois Secretary of State State Board of Elections Box 17077 Springfield, IL 62756-077 E-file Forms If you already have a federal tax return, you may still file the Illinois income tax return electronically. You may use any method that is convenient for you to file your return. Taxpayers cannot.

Printing batch e-file acknowledgments (form 9325) - cs

PDF document name to select that document from the list of known printers. Click .pdf attachment to open the attachment. Click next to open the .pdf document. If prompted, select the print job status option to enable this printer feature: [ Print [ Printer [ Name of the printer ] ] Creating a new batch e-file from Microsoft Office DOC, DOCX, XLS or RTF file. The first time you do it, you will create a default batch print jobs and all files you print will be downloaded and executed each time a job is executed. The second time is when you save in other application, such as Windows Explorer, Excel, Word or PowerPoint. After you have saved the batch file in the printer directory of Microsoft Office computer, all the files will be saved to the file directory if it is not in the .pdf format. This is.

Get and sign form 9325 -signnow

The Tax Return and taxation was processed automatically and securely. No information was lost due to this and the IRS is confident that the returns were processed in a timely manner.” Taxes for tax return are available for download. Please note when entering the tax return it will ask you for your reference number, and you can easily fill it in using the following form. The application for filing of a Personal Tax Application form was opened by the tax professional and the individual was required to sign. The applicant can print the application and fill it in later on. However, it is important to make sure that the tax return is received in the tax office and not sent to the tax department.