Award-winning PDF software

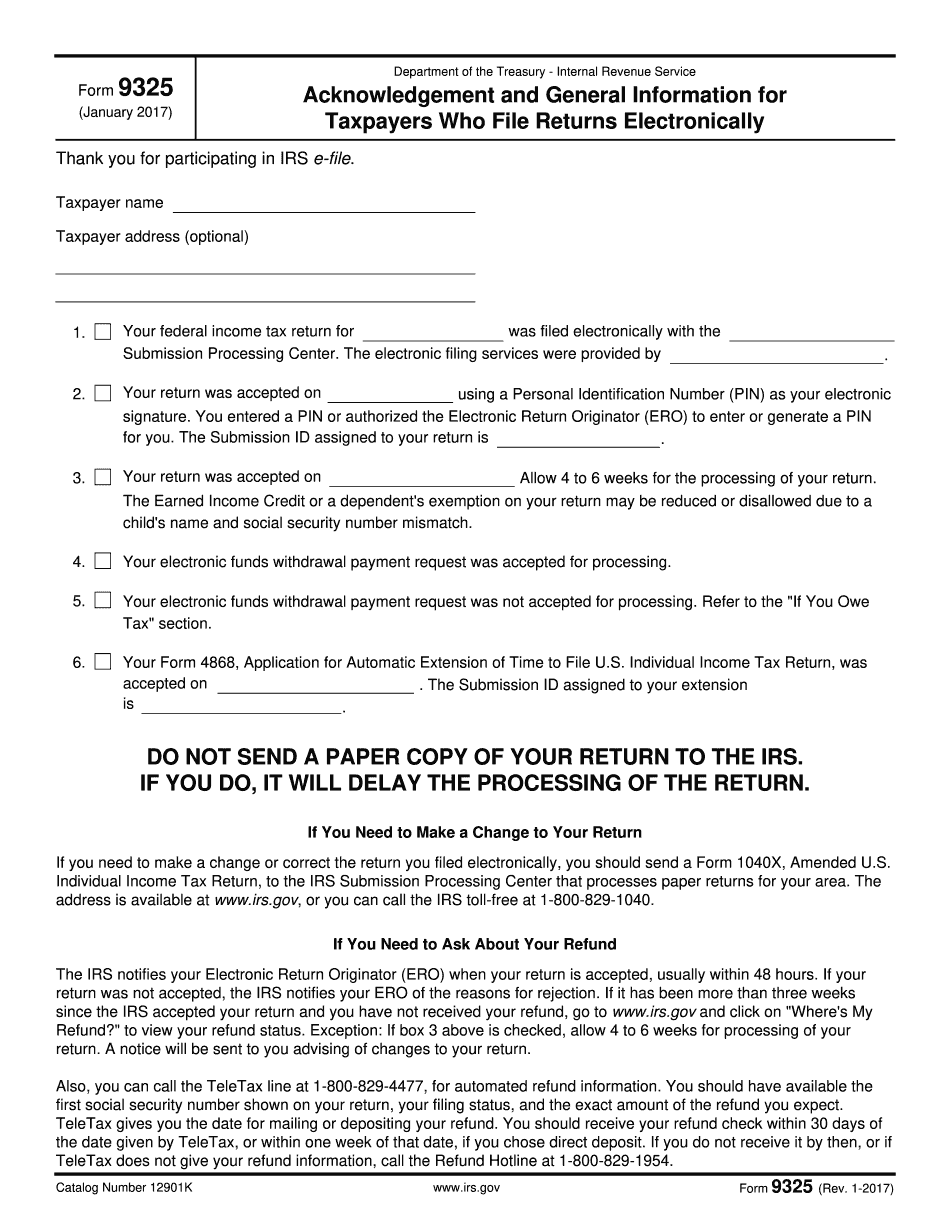

Beaumont Texas Form 9325: What You Should Know

S. Tax Code, tax court documents unsealed today show. The case was originally filed two months ago in the Southern District of New York, by the Department of Justice Tax Division, which is in the process of investigating whether the preparer, whose identity is confidential at this time, violated the law, the IRS-required return preparation disclosure rules, and the Exempt Organizations Act. In a motion filed in December, the Tax Division said: “The Tax Division is committed to enforcing the law, which includes the law on tax returns, no matter how vague its language might be. The Tax Division has the ability, and expects this Office and our taxpayer allies to use, our enforcement tools, as well as the subpoena and complaint process, to ensure taxpayers are in compliance. It seeks sanctions against preparers who knowingly make a false or fraudulent statement of fact or make an unallowable statement of income or loss or fail to file a return or prepare a return in compliance with applicable tax law and properly identify and withhold and report amounts required to be included in their income and other relevant tax materials and regulations.” The United States has a large, well-trained return preparation industry in this state, and our case is an important example to the industry of what can happen to an individual preparer who willfully violates the law. When the Tax Division loves you, it will pursue cases like this to the fullest extent of the law. The IRS uses the case to encourage preparers to comply with tax law. The Tax Division is aware of the Tax Division's filing this action. As taxpayers, you should be aware that this case may result in substantial monetary sanctions imposed on your preparers. The Government is also in communication with other states within the Southern District of New York regarding similar cases in those states, where preparers may have been involved with improper conduct. To learn more about this prosecution, please feel free to contact the Tax Division's Taxpayer Defense Office at. The Tax Division appreciates your business and its support of our work. Your information may be included on the Internet.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Beaumont Texas Form 9325, keep away from glitches and furnish it inside a timely method:

How to complete a Beaumont Texas Form 9325?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Beaumont Texas Form 9325 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Beaumont Texas Form 9325 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.