Award-winning PDF software

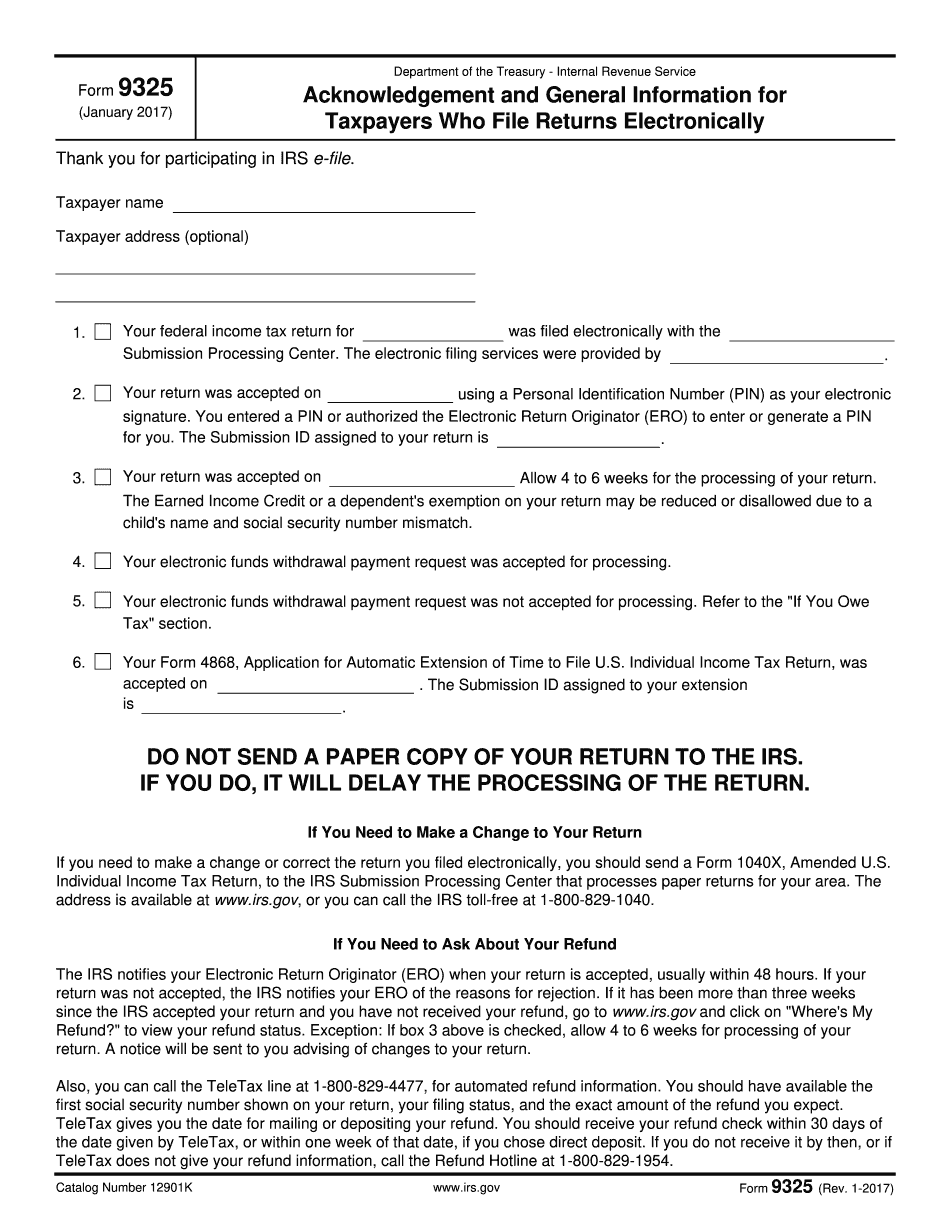

Form 9325 for St. Petersburg Florida: What You Should Know

The following is a list of license information and references for commercial sellers and license/certification holder applicants that must be filled out when applying for a new permit or renewal. (All fees for a commercial listing are determined on a listing basis and cannot be increased at the time of application.) Listing Fee: 35.00 Certificates: Permit Number: 6032903 Permit Name: Permit Renewal Number: Liability Waiver: Commercial Listing Fee: 120.00 Records: Florida Department of Revenue: Records can be maintained by an external service or a certified county recorder as well. Contact your county recorder's office for information. . The Taxpayers Bill of Rights This taxpayers bill of rights provides important information to all citizens concerning taxation and the right to dispute tax audits. The Florida Taxpayers Bill of Rights provides the right to: · Know Your Rights as a Taxpayer. To review the Florida Taxpayers Bill of Rights click here. · File a Complaint. A complaint filed with the Tax Collector shall proceed exclusively through the administrative process without the intervention of the Court. If the Tax Collector's decision to proceed with a complaint is not in accordance with this Florida Taxpayers Bill of Rights, the Tax Collector shall have the right to appeal the decision to the Office of Administrative Hearings and the Office of Independent Auditors within 30 days. · Protest the Tax Collector's Actions. To protest the Tax Collector's decision to continue with a complaint or continue proceedings against you, file a Notice of appeal via the Florida Taxpayers Bill of Rights. You may also submit a complaint and request a hearing directly to the Tax Collector. The notice of appeal period is 30 days from date of filing of your Notice of appeal. The Tax Collector, within 15 days thereafter, must notify you that he or she has decided that he or she will review the complaint or proceed with the proceeding against you. The Tax Collector must then notify you within 15 days, whether he or she will proceed with the proceeding against you or request a hearing. · File a Suit. In the event that any party has failed to comply with the provisions of the Florida Taxpayers Bill of Rights, both parties may file an action for equitable relief to compel compliance. · Have a Hearing.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 for St. Petersburg Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 for St. Petersburg Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 for St. Petersburg Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 for St. Petersburg Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.