Award-winning PDF software

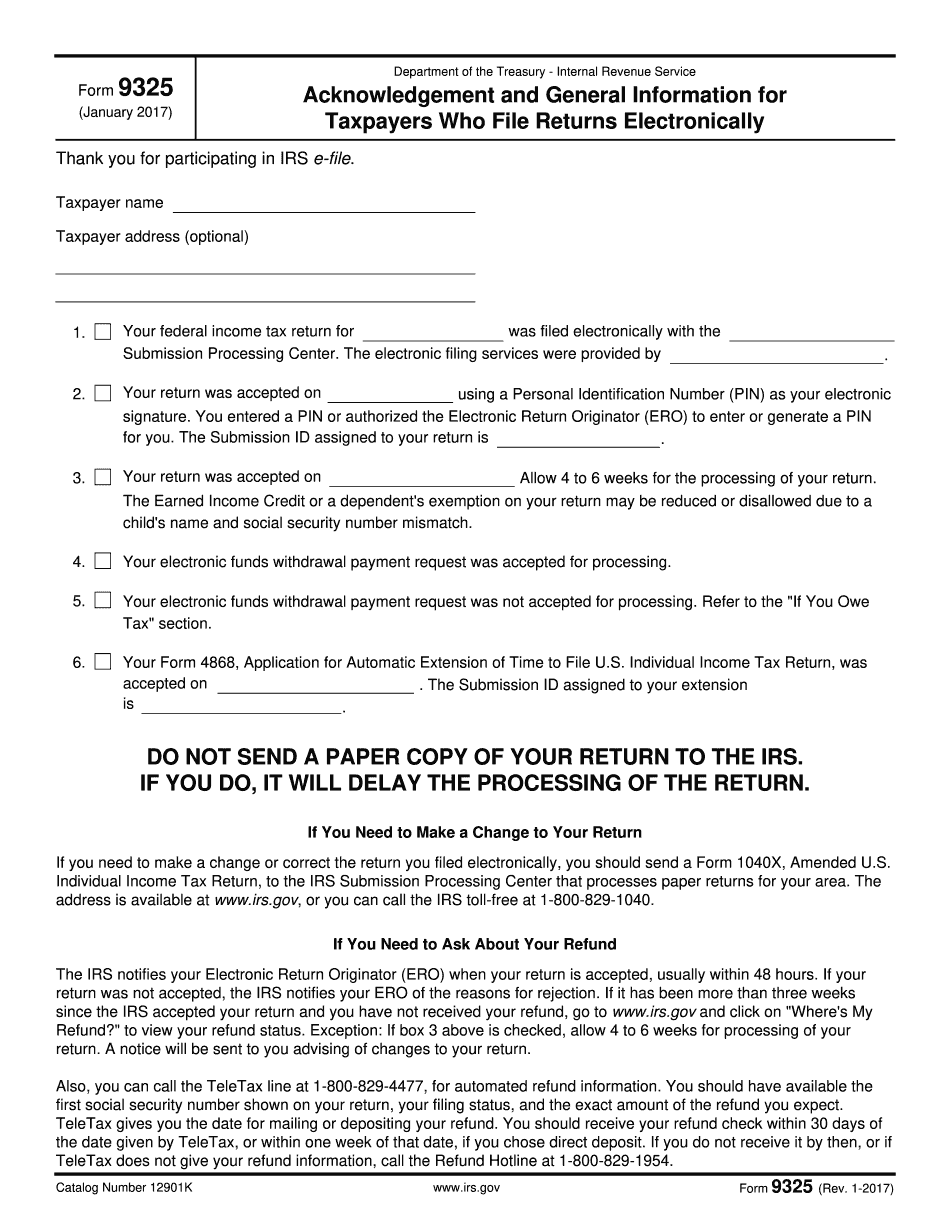

Form 9325 online Arvada Colorado: What You Should Know

You may also order Form 9465 by calling 1-800-TAX-FORM (). If approved, the. 10846: Form 9325 After IRS Acceptance — Notifying the Taxpayer This option enables Drake to email a completed Form 9325 to the taxpayer when a 1040 return Form 9325 can also be printed from the online EF database. Get the Tax Rates by County for Your County As a seller of goods and services in the state of Colorado, you must collect, process, and remit sales tax using specific forms and rates. The following sales tax rates apply to Colorado consumers in all counties. All sales tax amounts are subject to Colorado State Sales Tax. Sales tax rates change frequently and are subject to change without notice. The Colorado Bureau of Investigation (CBI) reports and publishes quarterly sales tax rates and other information for counties in Colorado. Please review the Colorado Bureau of Investigation (CBI) annual sales tax report at . It is a very informative report and will detail sales tax collected in each county in Colorado. Sales tax rates per county in Colorado are based on the following factors and are subject to change without notice: County Size: The larger the population of a county, the higher the sales tax rate that applies to all Colorado residents resident in that county regardless of age or type of transaction. The larger the population of a county, the higher the sales tax rate that applies to Colorado residents in that county regardless of age or type of transaction. County Sales Tax Rate: This is the percentage rate that applies to the total sales made at all retail establishments in a given county. A portion of these sales may be taxed by local governments that do not collect tax themselves which is why they are referred to as “off-site” sales. Some cities may have an additional tax which will apply to off-site purchases. This is the percentage rate that applies to the total sales made at all retail establishments in a given county. A portion of these sales may be taxed by local governments that do not collect tax themselves which is why they are referred to as “off-site” sales. Some cities may have an additional tax which will apply to off-site purchases.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 online Arvada Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 online Arvada Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 online Arvada Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 online Arvada Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.