Award-winning PDF software

Form 9325 online Fargo North Dakota: What You Should Know

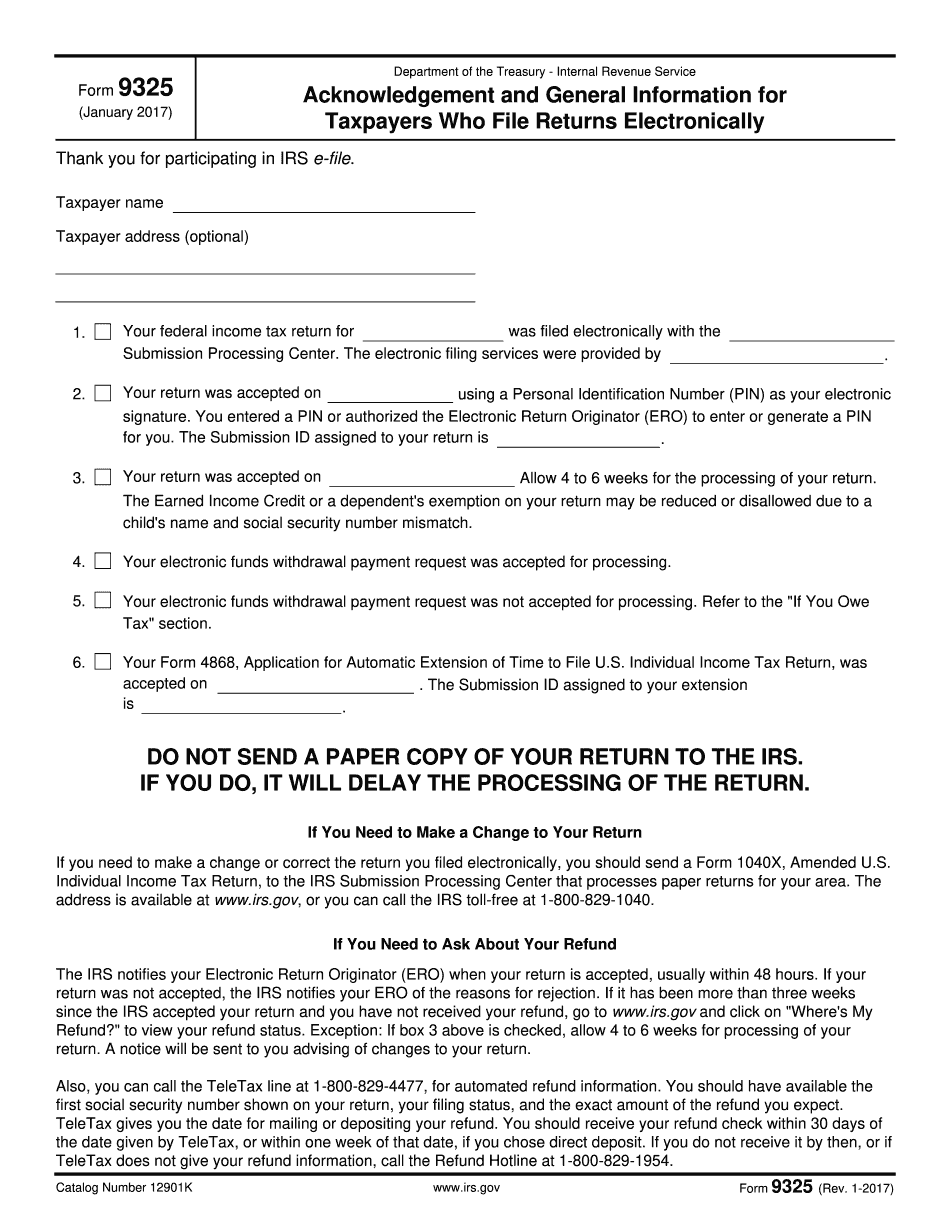

Search online by type: Form 9325 — North Dakota State Tax Commission; or, Form 9328: Self-Employed Individuals Withholding Tax Return — The Income Taxpayer Form 9325 will be completed, signed, and e-filed in all 50 states using a 1040EZ electronic filing system. Form 9465 — IRS You can view and print a copy of Form 9442, U.S. Individual Income Tax Return for Electronically Filed Returns, at the time you file your return, which is no later than 5 p.m. local time on the due date for tax. Form 9442: U.S. Individual Income Tax Return — The Income Taxpayer Form 9442 is a paper alternative to the computer system. For a detailed description of the electronic filing process, click here. Your tax return should be filed by e-Filing the appropriate type of tax return, as indicated below. If a paper return is required, you will be able to fill the form out online using the e-payment option. North Dakota State Tax Commissioner The North Dakota Income Tax Commissioner's office is responsible for collecting and remitting the North Dakota sales and use tax, franchise, and personal property tax, unemployment compensation tax, and special property tax. Income is subject to North Dakota income tax, based on income limits established by the Constitution of the State of North Dakota, and as provided by the provisions of Statutes. Sales or use taxes may be imposed by county or municipality when such a tax may be assessed on an owner, lessee, or user of real property or personal property for tangible personal property within the boundary lines of a single municipality. The North Dakota State Tax Commissioner The Commissioner provides the following services: Dedicate the services of the North Dakota State Tax Commissioner as Taxpayer Advocate. The IRS has provided the Commissioner with the necessary guidance to carry out its duties under the law. North Dakota Tax Commissioner's office State of North Dakota, Department of Revenue 1219 W, Suite 5 Sioux Falls, SD 57105 Phone: Fees: Forms are 100 (1) North Dakota Sales and Use Tax Returns (download & print) (1) County or Township Tax Certificate, if applicable.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 online Fargo North Dakota, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 online Fargo North Dakota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 online Fargo North Dakota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 online Fargo North Dakota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.