Award-winning PDF software

Form 9325 online Plano Texas: What You Should Know

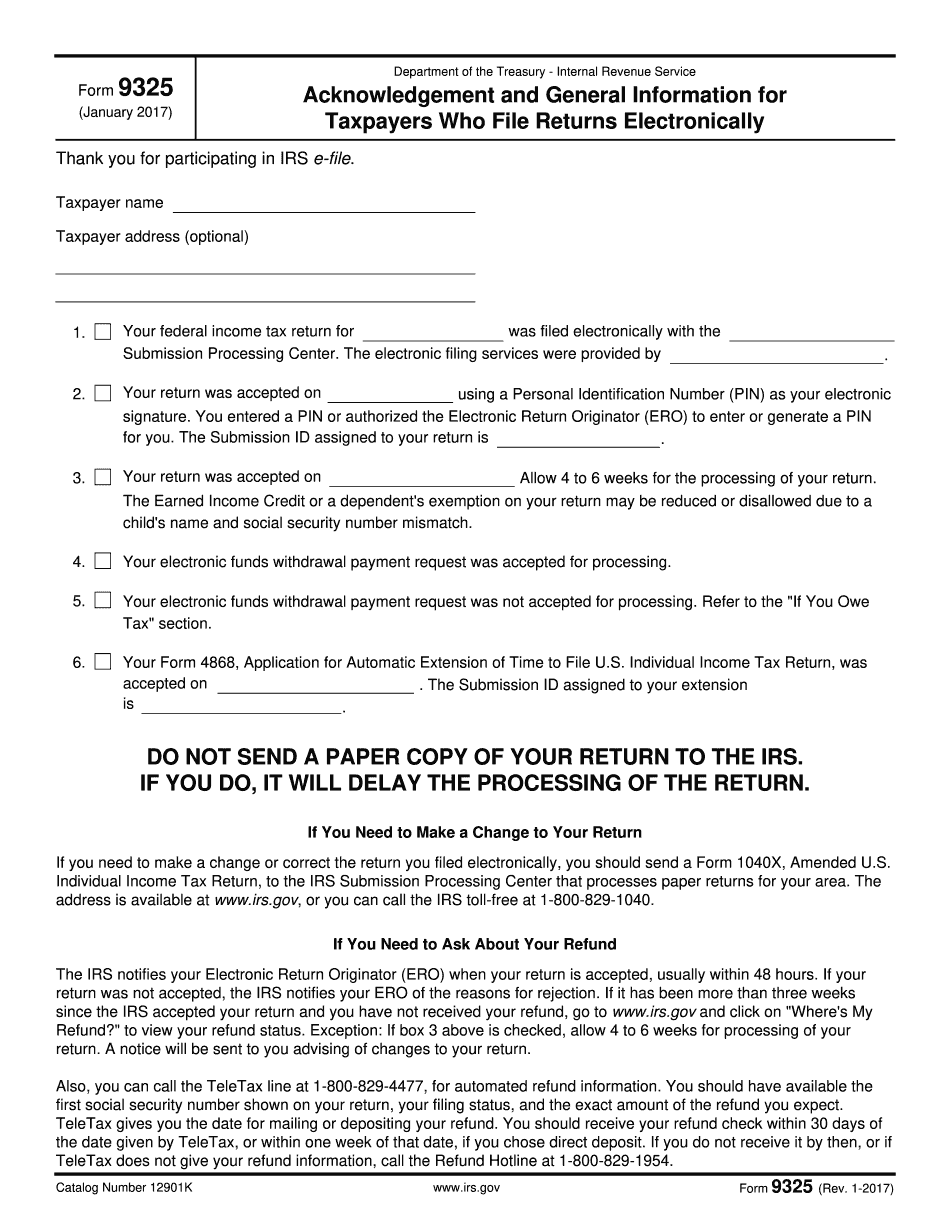

Either way, the taxpayer has to review the form in person after receiving it for signature. The only time a taxpayer may not get a receipt of this e-file receipt is if an employee at e-file.com makes a mistake. If the taxpayer does not have a copy of Form 9325 for their records, then no e-file is involved. After Form 9325 has been issued, you will have this message displayed under the e-file tab in Chub: You will now notice that the “Sender's Name” is: “Drake, N.D. Tax & Accounting Services, Inc.” That's right, this form is being sent to an address which has not been filed for the first time at all. Now, it may have been filed as “Nathan Drake, Jr. (Citizen) Inc.” but, that's not an e-file address. An e-file address was provided when the taxpayer completed the application. After the taxpayer is approved, then no e-file addresses on Form 9325 are needed by the sender. The sender does not have to fill in any information, unless otherwise instructed by your account manager at Drake. The sender has the ability to send an e-file receipt via fax to the taxpayer at N.D. Tax & Accounting Services, Inc.” It might be worth looking into this further, as this could be a big inconvenience for some. If someone has been able to “trick” the system and file the “Nathan Drake, Jr. (Citizen) Inc.” return to the past, then it could be an issue. At least they had a chance of being approved and receive the Form 9325 e-file receipt prior to sending form 9325 to the taxpayer. 10847: Form 9325 after IRS approval You must mail the tax return or extension to: Tax Rate Reduction Service Inc. ATTN: IRS E-File 10175: Requesting a Form 5329 — Payroll Tax Payment Deadline This is a form you must have at your request before the end of the year in order to be notified of when you will receive your refund. 10175, 3333: IRS Payroll Payment Deadline To apply for the pay online portal, go to and click on the blue “Get Paid” button.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 online Plano Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 online Plano Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 online Plano Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 online Plano Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.