Award-winning PDF software

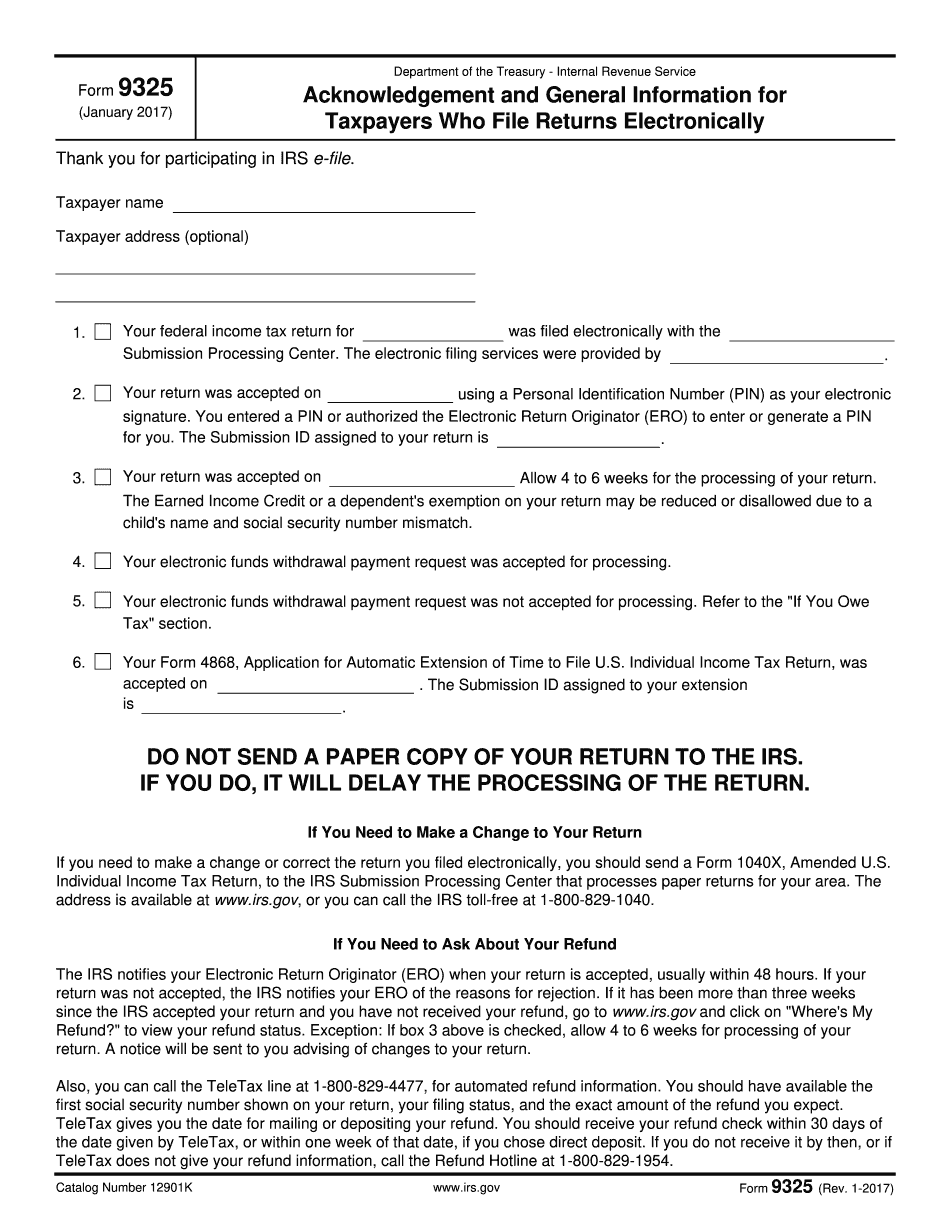

Printable Form 9325 Centennial Colorado: What You Should Know

Taxable Personal Activity (PPA) report for you and your employees; Record and report sales taxes at the source; Report exemptions on Schedule F; Record taxes to the state; Report, pay and send any other tax forms you need; Report and remit your business taxes electronically; Find out tax and property tax limits; Create and email tax return templates; Make sure you are using the most up-to-date software; and Use your smartphone or other device to access the City's Online Business Portal. Click here for more information. Employee's Supplemental Tax Act Employee's Supplemental Tax Act (ESTA), a state law, requires employers who employ their employees to withhold state and local sales tax on wages and reimburse state agencies when the employee purchases, repairs or services state-owned property. Learn more about the ESTA at the Colorado Department of Revenue. Earning a wage is not enough If you are receiving federal, state or local income tax or a social security benefit, you do not pay enough of that to cover your income. Learn about earning more in Colorado and how you can save money on your taxes. Municipal Budget & Revenue For a list of Colorado cities and towns that use city funds in order to provide some services to residents, see the City of Colorado's list. For information on how the city provides its services, view the City of Colorado's website at. A Colorado City may be exempt from State and Local Income Taxes. State Income Tax — Local Taxes A Colorado City may be able to claim a refund of state income taxes if the tax was paid by the taxpayer as a member of the city government. Learn about refund of state income taxes from the Colorado Department of Taxation. State Income Tax — State Tax The state may require an applicant to provide proof of residency and identity. If you qualify for an exemption from tax, you may be able to obtain the tax reduction. The state tax deduction is available to residents whose Federal income tax liability is at least 1,000 or the least of 20 percent of their Federal income tax or 7.65 percent of adjusted gross income Qualifying for a Colorado State Tax deduction can be accomplished through a filing status, marital status, or filing period. It is not necessary to have been eligible for an exemption as a resident of the state.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 9325 Centennial Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 9325 Centennial Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 9325 Centennial Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 9325 Centennial Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.