Award-winning PDF software

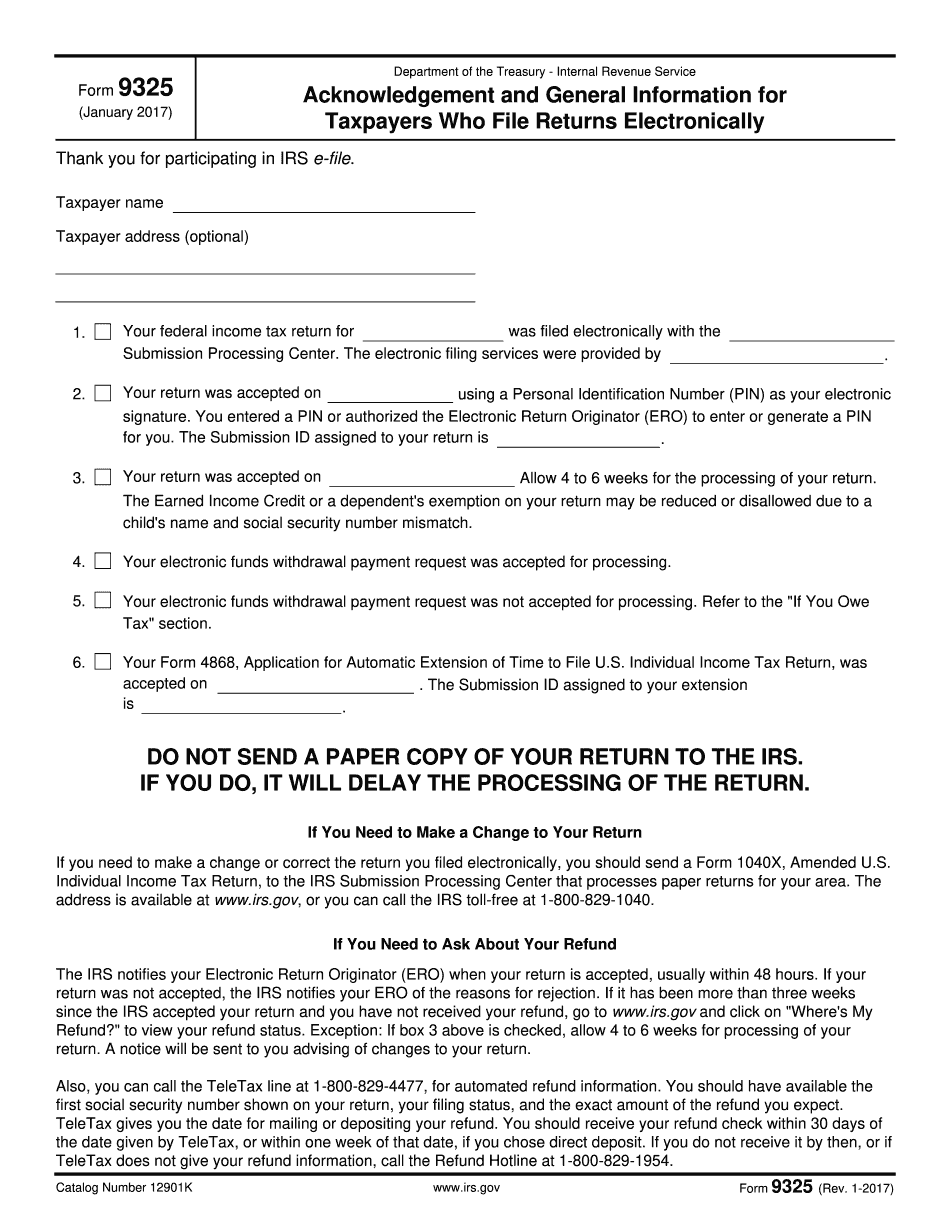

Wichita Kansas Form 9325: What You Should Know

IRS website. Epsilon for Federal Tax Counseling Agencies Epsilon offers the following services, which may prove useful during all phases of e-filing: • Form 8606 Electronic Tax Filing, to help taxpayers create a tax return for online filing. • IRS Forms and Publications Directory, an online repository containing all Forms 1040, 1040A and 1040EZ; as many print editions as an agency will allow. • IRS Transcripts, an online searchable database of the transcript and related documents associated with an individual taxpayer's income tax return, on all forms filed with the IRS. • E-Filing Tools and the American Taxpayer Relief Program, which allows taxpayers to set up appointment schedulers and track and control the delivery of all IRS e-filing services through the E-Filing Tool and the American Taxpayer Relief Program. Please Note: You should not use this information as a substitute for preparing, filing and paying your own Federal income tax. The only two exceptions are Forms 1040EZ and 1040A EZ, which are specifically designed by the IRS to meet the needs of taxpayers for electronic filing and return filing. However, the IRS encourages taxpayers to consider alternative tax filing options like electronic filing when possible. The IRS is unable to provide tax advice or assistance for any tax questions you may have, including any questions concerning taxes paid through the Internet. Please consult with a tax professional for any questions pertaining to the return filing process and or the tax consequences of an file. Eros provides tax advice and tax assistance to individuals, businesses and professional organizations for free, 24 hours a day, 7 days a week, in English and Spanish. The U.S. Department of the Treasury's Bureau of Internal Revenue is responsible for administering the Internal Revenue Code and other Federal tax laws. This includes administering taxes collected under those laws.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form 9325, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form 9325?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form 9325 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form 9325 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.