Award-winning PDF software

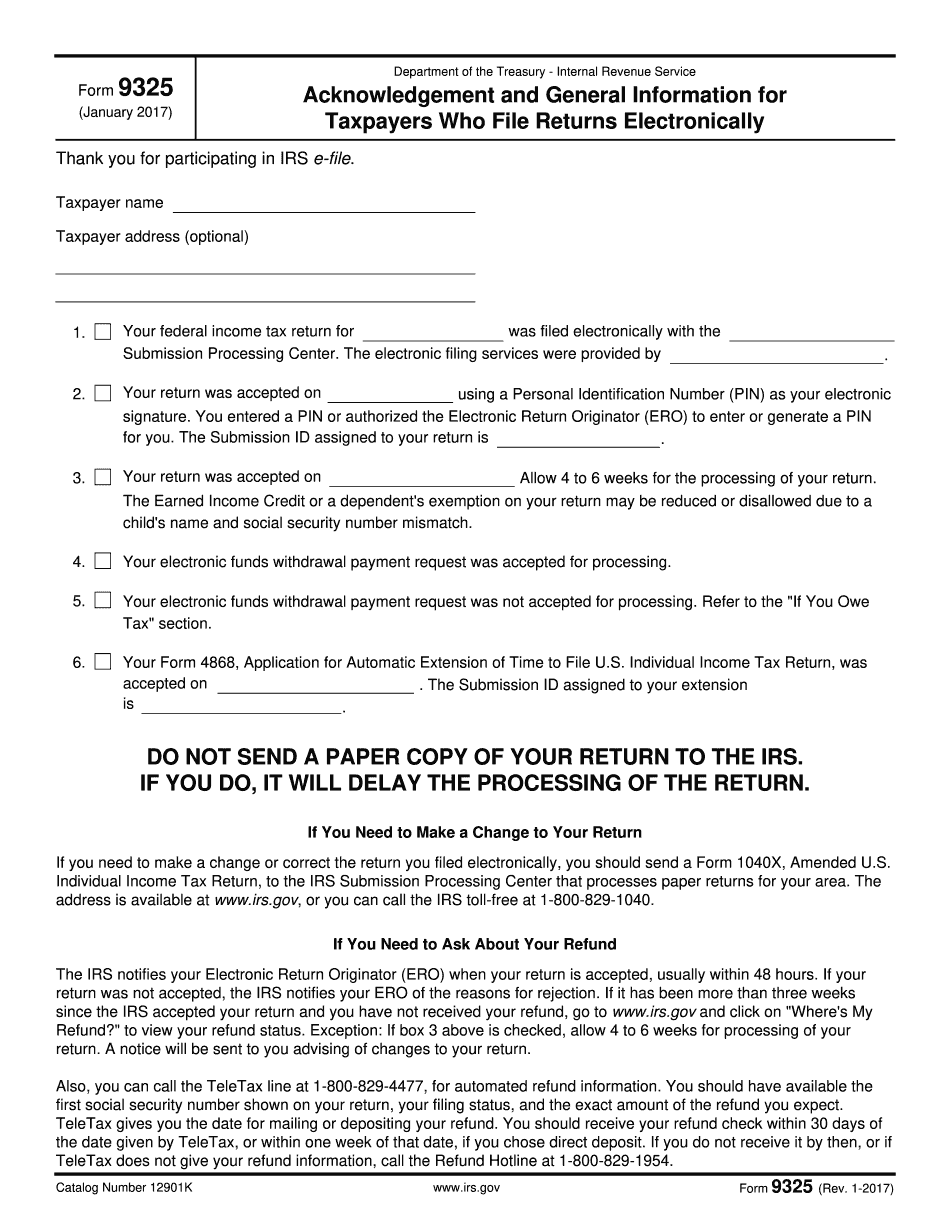

Form 9325 Illinois Cook: What You Should Know

Form 7329 — Notice for Disregard of Exemptions for Illinois and for the District of Columbia. Form 7320 — Notice of Tax Return Error. Form 7340 — Statement for an IRS Notice of Federal Tax Lien or Penalty Under Subtitle F to the Internal Revenue Code. Form 8453 — Electronic Request Form for Extension of Time to File U.S. Individual Income Tax Return Form 9205 — Illinois Corporate Tax Return. Form 9203 — Illinois Individual Tax Return. Form 1120 — Illinois Form of Corporation or Joint Venture Forms | Illinois Department of Revenue. Sep 8, 2025 — Beginning in 2019, all income, profits, and net-of-tax adjustments are subject to Illinois income tax withholding. Nonresidents not in Illinois have no Wisconsin or U.S. federal income taxes. Nonresidents will file with the Illinois tax department and make Illinois withholding claims. The Illinois Department of Revenue has a list of entities in the state that are exempt from withholding Illinois income tax. Income Tax Rates · Illinois Income Tax Calendar Sep 8, 2025 — Illinois has income tax brackets of: 1% to 8,250 – 150; 2% to 18,250 – 300. Sep 8, 2025 — If the adjusted gross income (AGI) of the taxpayer (or spouse if filing jointly) is: Over 8,250, no Illinois income tax Over 18,250, Illinois income tax for first 4,250, plus 3.75% Illinois and federal income taxes; Over 18,250, plus Illinois income tax on gross income from that point forward. The effective rate is calculated by the income tax factor. Individual Income Tax Forms — Illinois · Business, Non-Attorney Code Request Form. · Industrial / Commercial, Class 5 Industrial / Commercial, Official Appeal Rules of the Cook County Assessor. · Income Tax Forms currently selected · Miscellaneous Tax Forms currently selected · Sales & Use Tax · Excise Tax Forms currently selected · Income Tax Rates currently selected · Interest on Illinois Debt · Illinois Tax Form — 2025 · General Income Tax Information · Illinois General Incentive Plans · Interest on Illinois Debt · Income Tax Return · New Illinois Income Tax Forms · Wisconsin Income Tax Returns · Illinois Franchise Tax Board · Illinois Financial Tax Return. · Corporate Tax Return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 Illinois Cook, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 Illinois Cook?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 Illinois Cook aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 Illinois Cook from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.