Award-winning PDF software

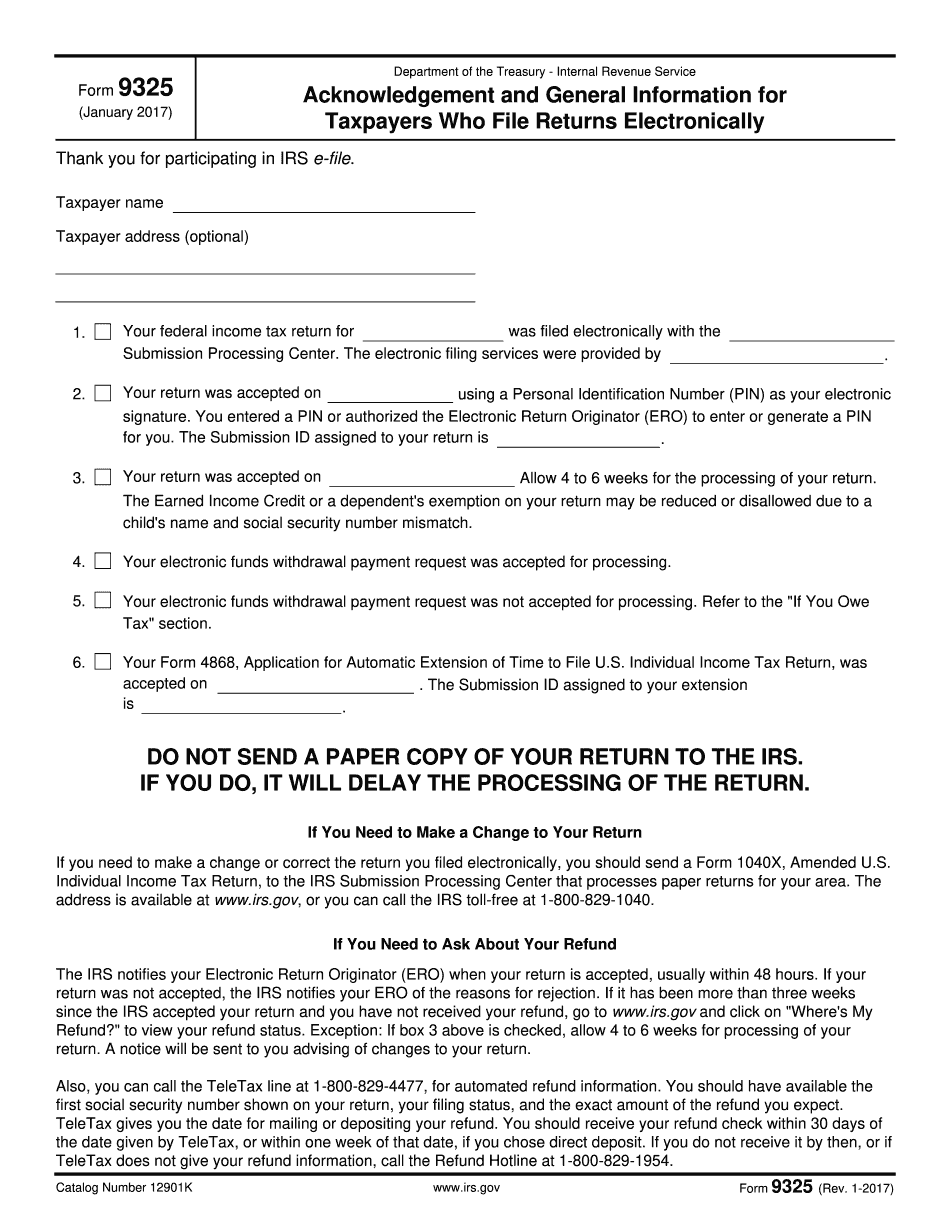

Pima Arizona Form 9325: What You Should Know

Form 1098— Return to Tax Information For Individual, Estate, or Community For more information or questions, please contact the Pima County, Arizona Community Education Department. Pima County Office 937 East Main Street, Suite 100 Pima County, Arizona 85716 This paper is an update to IRS Publication 771, Taxation of Education Benefits, which also contains an overview of the tax treatment of education benefits received by postsecondary institutions. The form is designed to provide students, post-secondary instructors and educational institutions with brief, detailed information on the income tax consequences of a determination that the student, instructor, or institution is not an eligible institution. The information provided in this form will help you understand why certain amounts can be deducted from your individual income tax return, and also how this determination affects other tax withholding obligations. (Read More) Form 2114-EZ, Employment Certification Statement for Individuals Sep 1, 2025 — Last day to report wages for the 2025 tax year — Effective in 2017 The information is in Adobe PDF format. If you need to download Adobe Reader, click Form 2118, Wage and Tax Statement For Employment, Wage Reporting, for individuals. The forms are formatted for paper filers. PDF Format. Form 707; Foreign Financial Earned Income Exclusion and the Foreign Earned Income Exclusion Sep 8, 2025 — Last day to report and pay estimated tax for the 2025 tax year — Effective in 2017 The information is in Adobe PDF format. If you need to download Adobe Reader, click Form 2123, Statement to Report Foreign Taxable Income. Instructions & Forms Instructions for using this form can be found online here. Form 2183, Form W-2 Wages, Employee Tips and Other Forms Instructions for using this form can be found online here. For more information, please contact your local United States Postal Service Office. Form W-2 Wages Instructions for using this form can be found online here. Form W-2 Wages for individuals Instructions for using this form can be found online here. Foreign Earned Income Exclusion Instructions for using this form can be found online here. Payroll Deductions For Individual Employees Instructions for using this form can be found online here. Forms 1098-T and W-2G for Foreign Financial Assets (W-2B, W-2C).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Pima Arizona Form 9325, keep away from glitches and furnish it inside a timely method:

How to complete a Pima Arizona Form 9325?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Pima Arizona Form 9325 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Pima Arizona Form 9325 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.