Award-winning PDF software

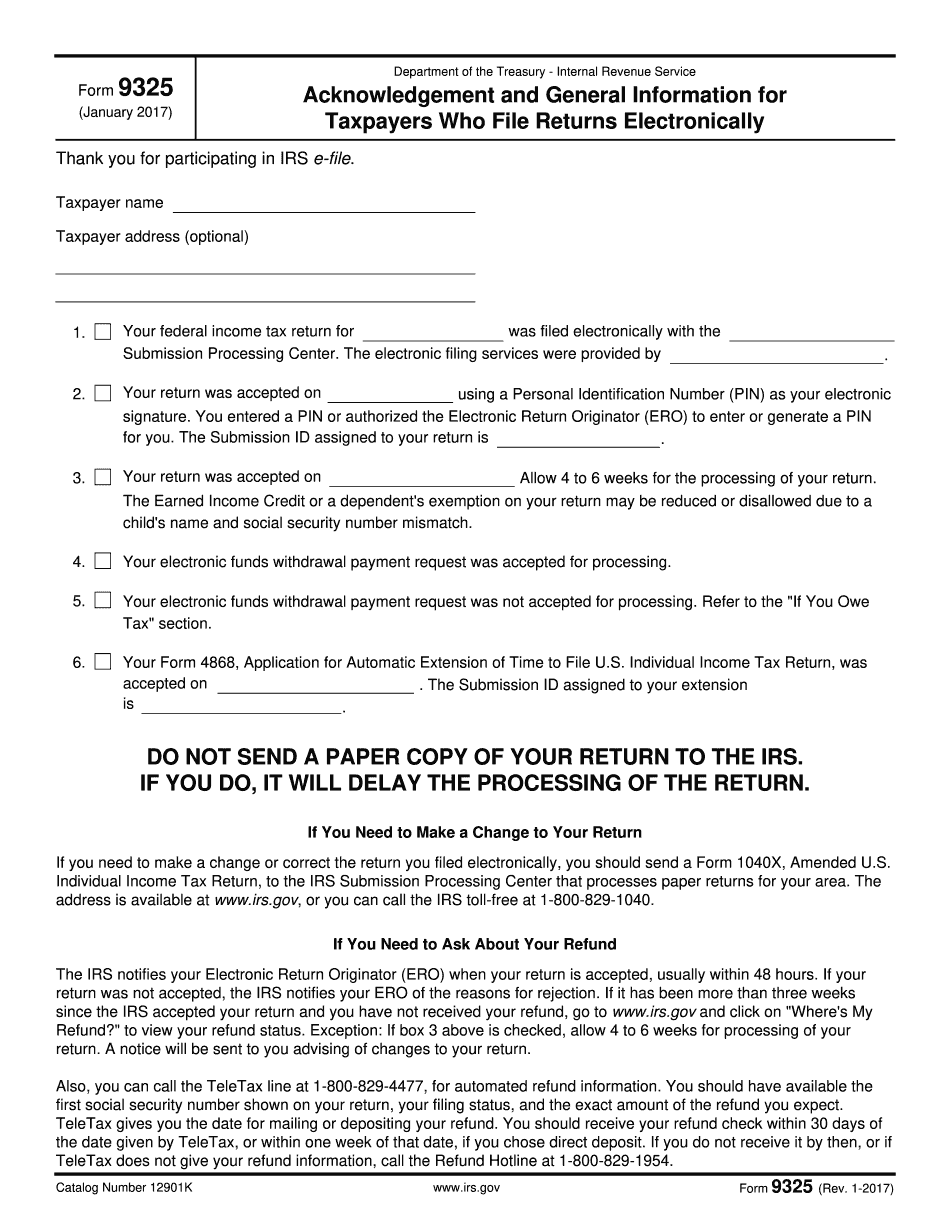

Form 9325 ND: What You Should Know

In the drop-down box that reads Filers are currently processing your e-file request “, click Browse. In the drop-down box that reads All filers are processing your e-file request “, click Add Filer. In the list, select the e-file that you want to upload and click Continue. On the Summary screen, use the drop-down box to select to have Drake deliver the e-file to the taxpayer and click Submit. Filing an e-file Before you file your e-file with your e-services provider, the e-file must be verified through the Internet Tax Service (ITS) if you are filing your e-file with a computer or mobile device, check the status of your e-file when using a paper check: If you are filing your e-file within 30 days of the date of you request, you get a digital copy to the e-file address listed in the e-file request. If you are filing your e-file after the due date, you receive a new e-file to your original address. Note: This does not include the current status of your e-file or the current status of the EZ Filing Status option in your account, which is why we're unable to post it until it has been received. There are two options to submit your e-file online: The IRS filing Status option. Note, as of 12/2/2016, the IRS no longer accepts digital copies of paper e-file submissions by mail at this location. To use this option, you must download and use the latest version of the IRS filing software. Note, if you are not using the version of the IRS e-filing software that the IRS is shipping, we cannot verify your e-file, and we cannot get a new e-file for filing by mail. If you cannot see your current e-file status, open up your account and look at My Account at IRS.gov. Send your e-FILE request to the e-services provider. It is likely that there will be a delay in receipt of your paper e-file. If this process seems cumbersome, you can request a paper “paper-check e-file request”, which is a paper e-file that should receive your check within three business days after it is received by the provider.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 ND, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 ND?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 ND aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 ND from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.