Award-winning PDF software

Form 9325 online DE: What You Should Know

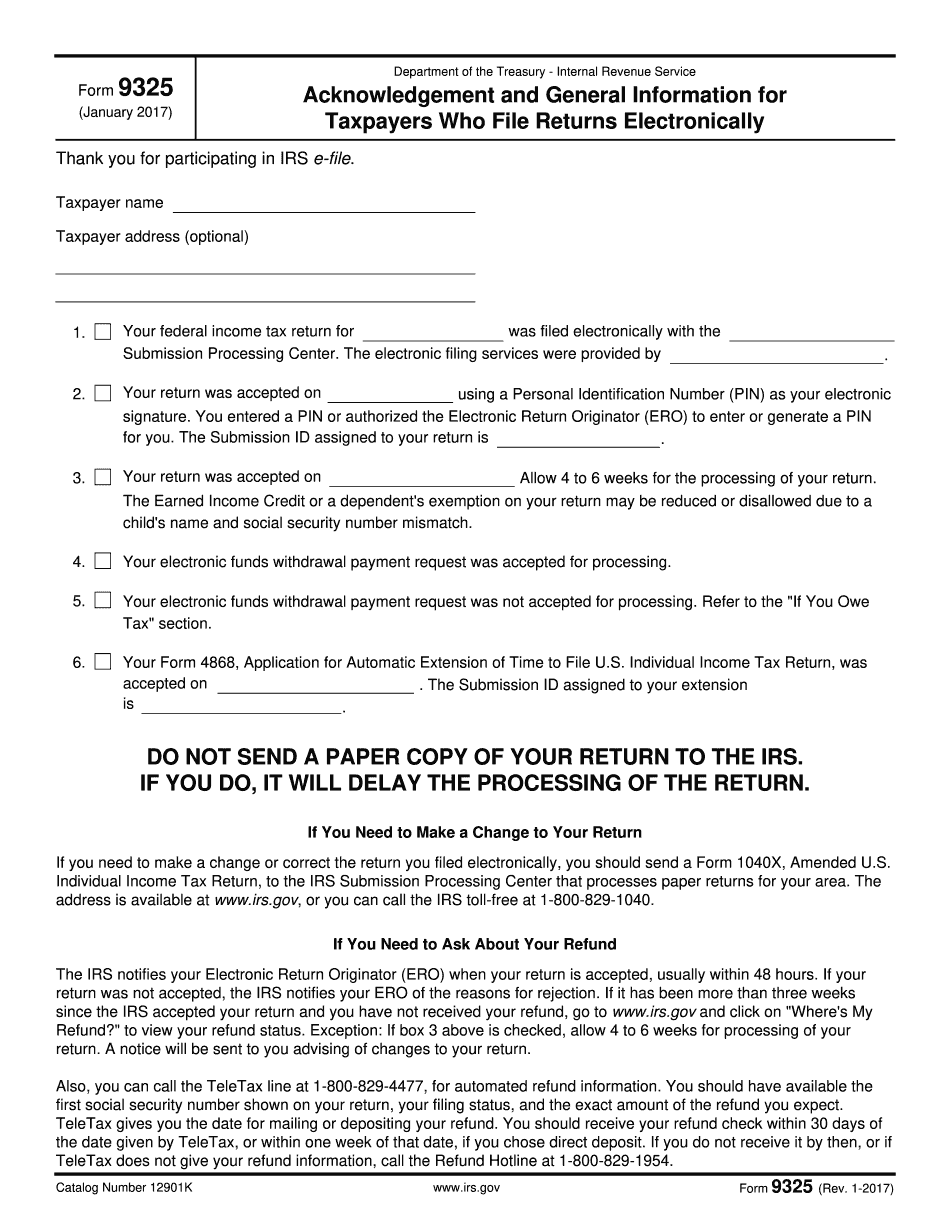

Form 9325 provides the following information to the customer by email : The taxpayer's name, address, taxpayer identification number (TIN), and filing status (Individual, Married, Common Law Partner, Qualified Widow or Widower, Qualified Spousal or Domestic Partner). Additional taxpayer identification number (TIN) and proof of taxpayer identification as defined under IRM 21.3.1.2.3.4.3. Form 9325 — General Information In the case of taxpayers where the original taxpayer identification number (TIN) was not found or could not be retrieved, but the taxpayer name was found and is listed in the return, include the name below and the address (including zip code) of the taxpayer's tax preparer. The information included in Forms 9325 can also be incorporated into Forms 1041, 1040A, and 1040EZ when provided by the taxpayer. If the taxpayer name was found, but a TIN was not printed, indicate that in the “Taxpayer name” section. Note: If the address was not printed, indicate on the return the mailing address for the taxpayer at least as close as the address as printed in the form In the case where the TIN was printed by a different person than the taxpayer whose name is entered in the return, it should be indicated upon the form whether to give the TIN to the taxpayer. If the TIN is located on the same page where the information about the taxpayer and the taxpayer's return is listed, no other information from the form need be entered. Receipt for Form 9325 Form 9325 includes a request for an electronic receipt of the form and, as a result, the user must ensure that they have a way to record their receipt of their form online at least 10 days after the receipt of the form (not including Sundays). If no other electronic record is available at the time of the electronic receipt, the form will be sent automatically to the taxpayer on or before a date or on the 30th day following the transaction date (or the date the taxpayers has made available the information received). In the event of a transaction that was not authorized by the taxpayer, the user must ensure that they have an electronic record of the electronic transaction and send the form in the case where a computer virus or other tampering with an electronic record is suspected to have occurred or occurred.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9325 online DE, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9325 online DE?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9325 online DE aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9325 online DE from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.